Legal Information & Terms and Conditions

Last Update: 15th of March 2021

These General Terms and Conditions (“GTC”) are the Legal Agreement, concluded between iCard AD, www.premiocard.com, with seat and registered office at: Business Park Varna, building B1, Varna 9009, Bulgaria, UIN: 175325806, info@premiocard.com, authorized and regulated by the Bulgarian National Bank as an Electronic Money Institution under the Electronic Money Directive 2009/110/EC (the “EMD”) and Directive (EU) 2015/2366 (the “PSD2”) with license No. 4703-5081/25.07.2011 , Principal Member of MasterCard, VISA and JCB, (hereinafter referred to as “Issuer” or “iCard”) and Client.

The Agreement will be effective from the date of acceptance by Client ("Effective Date").

1. Subject of the Agreement

1.1. Use of the Service by Client is subject to the Agreement. Client agrees to use “PremioCard” (“referred to as the “Service”), which is a prepaid card, issued by Issuer with the logo of a Card Organization, to which Business Clients can send money via transfer from the Premiocard platform. The card can be used for purchases on POS, Internet and ATM cash withdrawal, with personalized security characteristics, such as PIN, expiry date, CVC and other. Card may be non-reloadable or reloadable, depending on Card Program. Currency of Card, transactions, fees and limits of Issuer are described in Tariff, which is part of this Agreement. Card represents electronic money, issued by Issuer on receipt of funds, registered in electronic form in Issuer IT System and indicated as a Balance, which represents a claim of Client against Issuer for redemption. E-money is not a deposit. E-money, and therefore the Service are neither subject to any Financial Services Compensation Schemes nor any public or private insurance schemes. Card to card transfers are not allowed. Cash loading is not allowed.

1.2. Client may receive information on Legal Agreement, fees, limits, balance, transactions and manage the security of Card via platform provided by Issuer, such as www.premiocard.com, or similar User Interface, including mobile application (if applicable), which Client accesses with Client’s Identifying credentials.

1.3. Use of the Service depends on the type of client. Business Clients on the PremioCard platform may load the PremioCard with money and are parties to a separate legal agreement. The Client, defined as a party to this GTCs herein, may only use PremioCard to spend money by executing card transaction as described below. Issuer may introduce innovations, improvements, development, put or remove limits for risk or compliance reasons or amend the Service unilaterally and without the consent of Client, unless such prior notice is required by law.

2. Accepting the Agreement

2.1. In order to use the Service, Client must firstly agree to the Agreement as described hereunder. Client may not use the Service if Client does not accept the Agreement.

2.2. Client must provide directly to Issuer current, complete and accurate information for the purposes of the applicable AML, KYC and compliance requirements, imposed on Issuer and must maintain said information updated during use of the Service. In case of any changes in information provided by Client, Client agrees to update the information in the User interface for the Service without delay.

2.3. Issuer may require additional information as a condition of continued use of the Service or to assist in determining whether to permit Client to continue to use the Service. Client agrees to provide such information without delay, as Issuer may require in this regard.

2.4. Client can accept the Agreement by:

(a) Clicking to accept or agree to the Agreement, where this option is made available to Client by Issuer during registration through the platform for the Service; or

(b) Signing the Agreement on a hard copy, if requested by Issuer; or

2.4.1. By clicking to accept or agree to the Agreement, where this option is made available to Client by Issuer in the User interface for the Service the contractual relationship between Client and Issuer is concluded by electronic means of distant communication, as defined in Directive 2001/31/EC on the electronic commerce and other applicable laws. Clicking to accept or agree to the Agreement, where this option is made available to Client by Issuer in the User interface for the Service represents an advanced digital signature made by Client and therefore the electronic document of the Agreement is deemed as duly signed by Client. In case the Agreement has been provided to the Client on a paper version as well or in a language version different from English, this is only for the convenience of the Client and the parties agree that the prevailing version will be the electronic version, which is available to the Client in the platform www.premiocard.com. Any updates made by the Issuer shall be made in the electronic version of the Agreement according to the requirements of the law and shall be valid with respect to the parties.

2.5. . Client may not use the Service and/or may not accept the Agreement and Issuer may temporarily stop or terminate the Service immediately and without prior notice to Client, if:

(a) Client is not of legal age to form a binding contract with Issuer and to operate the payment instrument; or

(b) Client is a person barred from receiving the Service under the applicable laws or Regulations of Card Organizations or other Organizations or rules or policies of Issuer;

(c) Client has not been dully identified or verified by Issuer, upon single discretion of Issuer; or

(d) Other important reasons, upon discretion of Issuer, such as risk and compliance.

2.6. Issuer shall be entitled to notify Client at any time on non-acceptance to the Service or termination of the Service via e-mail. The decision for the refusal is strictly in Issuer’sdiscretion and Issuer shall not be liable for whatsoever compensations.

3. Provision and language of the Agreement

3.1. A copy of the Agreement will be provided to Client during the sign-up process. A copy of the Agreement, as amended by Issuer, is available to Client on the Issuer website for the Service. After sign up Client may request to be provided with the Agreement, and a link to the Agreement will be sent to Client email address for printing.

3.2. The Agreement will be provided to Client in English or other language for convenience of Client. If there is any contradiction between the English-language version of the Agreement and other language version of the Agreement, the English-language version takes precedence.

4. Activation of the Card and Use of the Service

4.1. The Service will be accessible to the Client after its successful registration on the platform for the Service or on a mobile application (if applicable), which represents a valid legal relationship with Issuer as well as a duly performed identification and verification of Client.

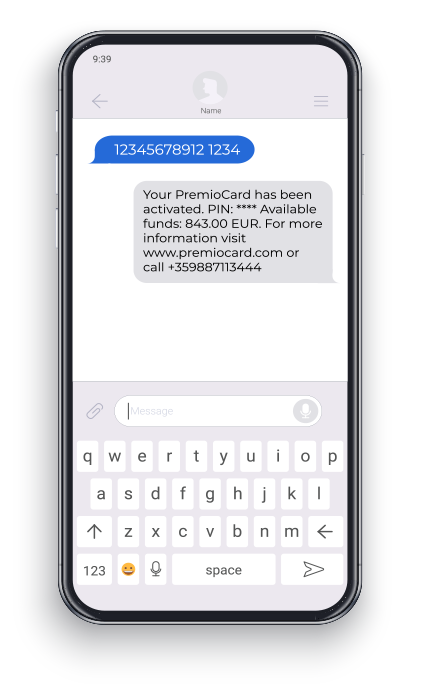

4.2. PremioCard is issued and delivered directly by Issuer. PremioCard may be used by Client only after its activation, as instructed by Issuer on the website for the Service or on the PremioCard package. The loading of the PremioCard with funds may be performed by a Business Client on the PremioCard platform. Issuer shall not be held responsible towards the Client in case of an inaccurate money transfer carried out by a Business Client on the PremioCard platform.

4.3. Client agrees to use the Service only as permitted by:

(a) The Agreement;

(b) Characteristics, settings and limits of the Service, including setting of limits by Issuer as allowed by the Service, as published and updated by Issuer from time to time on Issuer website for the Service; and

(c) Any applicable law, regulation or generally accepted practices or guidelines in the relevant jurisdictions.

4.4. Client may make transactions with the PremioCard for payments on POS or in Internet at Merchants accepting PremioCard as payment method, or ATM withdrawals. The payment order executed with Card will be received by Issuer in electronic form. The Client’s consent for execution of the payment transaction with Card becomes irrevocable and the payment order becomes irrevocable when Client presents PremioCard for execution of the transaction and:

(a) the chip or the magnetic stripe of Card is read by the ATM or POS device and a valid PIN and/or Client signs the receipt from the device; or

(b) by giving the Card or entering it into a terminal and reading of its chip on a self-service terminal; or

(c) by entering the data of Card, such as the 16-digits number, validity date or CVC2 code in the Internet; or

(d) by providing the card data (number, validity, CVC2) to the provider of goods or services and authorizing him to use it for payment of the respective service by fax, telephone or other communication device.

4.5. Deadline for performance for payments with PremioCard by the Client. Issuer shall execute the payment with PremioCard immediately after the Client has ordered it and has given its irrevocable consent.

4.6. Issuer shall execute the payment transactions ordered by Client, provided that the balance of PremioCard is sufficient to cover the transaction amount and all due fees. Issuer may refuse to execute a specific transaction if there is not enough balance or Issuer reasonably believes that the payment order is made by unauthorized person or transaction is fraudulent, illegal or in breach of the present Agreement or any law or regulation.

4.7. Embossed Cards must be used only by cardholders to whom the Cards are issued. Members of the family of a Client with personalized card shall be considered as authorized card users with respect to Client’s liability. Non-embossed cards may be used by Client or third parties, to whom Client provides or makes available the Cards, for which Client is fully liable.

4.8. The Client agrees that the Issuer has provided PremioCard to the Client with limits as specified in the Tariff for the Service. To minimize the risk from losses and unauthorized transactions Client may set even more restrictive limits on its Card, as the Service allows.

4.9. Reversal of unauthorized transactions:

In the event of unauthorized transaction, the payment transaction is deemed to be correctly executed by Issuer in accordance to the Payment service directive and applicable legislation. Client may submit a Request for reversal of unauthorized transaction to Issuer via e-mail without undue delay and within 30 days after Client has known for the transaction and in case Client is a Consumer - no later than thirteen (13) months after the debit date. This term shall not release Client from Client obligation to notify Issuer immediately and without delay in case of loss, theft, misappropriation or unauthorized use of Card/s and to take all preventive and security measures as allowed by the Service or Issuer to limit the risks and damages. Client who is not a Consumer or who has provided the Card or its personalized security characteristics to a third person cannot claim that a transaction is not authorized, because of lack of Client consent for the transaction.

5.1. Client acknowledges and agrees that Agents or sub-contractors of Issuer may be entitled to provide the Service or part of the Service to Client, in which case the ultimate liability towards the Client is with the Issuer.

5.2. Issuer is constantly innovating in order to provide the best possible experience for its Clients. Client acknowledges and agrees that the scope, form and nature of the Service which Issuer provides may expand without prior notice to Client. Where a change to the Service constitutes a modification to the preliminary information, which Issuer is obliged by law to present to Client prior to concluding this Agreement, Client will be given notice by an email sent to Client email address.

5.3. Client acknowledges and agrees that Issuer may stop providing the Service to Client, as provided in the Agreement. Client may stop using the Service at any time, without need to inform Issuer when Client stops using the Service.

5.4. Client acknowledges and agrees that for risk and compliance reasons Issuer may establish general practices and limits concerning the use of the Service without prior notice to Client, including, without limitation, individual or aggregate transaction limits, limits on type or number of transactions during any specified time period(s). Client acknowledges and agrees that if Issuer blocks the card for risk or compliance reasons, Client may be prevented from using the Service. Issuer is entitled to block the Card only in cases where there are reasonable doubts that the security of the payment instrument is compromised, in cases of suspicion for unauthorized use of a payment instrument detected by the Issuer or reported by the Client and in cases of use of the payment instrument for fraudulent purposes. In any any case of these cases the Issuer shall notify the Client about the blocking operation.

5.5. Issuer may refuse to execute any transaction or other use of the Service if Issuer has reasonable grounds to suspect fraud, a breach of the applicable Agreement by Client or a violation of law or regulation of Card Organization or other Organization. Transactions may also be delayed due to Issuer’s compliance with its obligations under applicable anti-money-laundering legislation, including if Issuer suspects that the transaction involves fraud or illegal or non-acceptable activities. In the event that Issuer refuses to execute a transaction, Client will be notified, unless it is unlawful for Issuer to do so or would compromise reasonable security measures.

5.6. Issuer is not liable for declined transactions or lack of Service, due to lack of enough balance in PremioCard, use of non-personalized cards (in case of Merchants not accepting payments with such cards) or offline transactions (PremioCards are generally not accepted for offline transactions, such as payments on toll roads, or other, however, this does not exclude Client liability for offline transactions, if any), lack of Internet, or problems with hardware or software of Client, exceeding the limits set by Client (if applicable for the Service), or the general limits, determined by Issuer, or any other reason beyond the reasonable control of the Issuer.

6. Information for the Service

Issuer provides to Client information for the Service, such as inquiries about the Balance of Card, transaction history, security settings, transaction alerts, terms and conditions and tariff, and other available on the User Interface of the Service. Issuer may improve, apply innovation, enhance, or change the way of providing information without prior notice to Client, unless prior notice to Client is required by law. Client agrees not to receive paper statements.

7. Personalized security characteristics of Card and identifying credentials for use of Service

7.1 Issuer has provided to the Client personalized security characteristics which comply with the principles of strong customer authentication for using all payment instruments, included in the Service, such as, but not limited to, password, OTP (one-time passcodes) received via SMS, or generated via special Mobile applications for access to online account, password for Mobile Application and others, which are necessary tools for preserving the security of your payment instruments. Strong Customer Authentication methods may vary depending on the particular setup or available devices of the Client. The Issuer shall make sure that the personalized security characteristics of the payment instruments are not accessible to parties other than the Client or user entitled to use the payment instrument, without prejudice to the Client’s obligations. The Service allows the Client to change its PIN code on an ATM device. The Client is responsible to memorize his/her personalized security characteristics and to ensure their confidentiality at all times. The Client should never disclose to anyone the personalized security characteristics. In case the Client suspects that someone has knowledge on the Client’s personalized security characteristics, the Client should inform the Issuer immediately. In case the Card is lost or stolen or in case the Client suspects that someone has knowledge on his/her personalized security characteristics, the Client is obliged to immediately notify the Issuer as described below.

7.2 Client agrees and is obliged to notify Issuer via Contact Center of Issuer or via e-mail, immediately and without delay in case of loss, theft, misappropriation or unauthorized use of Card, security characteristics or identifying credentials and to take all preventive and security measures as allowed by the Service or Issuer to limit the risks of unauthorized transactions and damages. Client also agrees to notify Issuer without undue delay and in the same manner of any other breach of security regarding the Service of which Client has knowledge.

7.3. Issuer may suspend the use of Service, including block the Card, after request by Client or in case Issuer suspects that their security may have been compromised or that unauthorized or fraudulent use has taken place, for which Client will be notified, unless such notification would compromise reasonable security measures or be otherwise unlawful. Issuer will unblock Card or access to the Service as soon as practicable after the reasons for the suspension cease to exist and providing Client meets Client’s obligations to Issuer.

8. Privacy policy and permissible transactions

8.1 The Issuer is authorized to process the Client’s data, including personal data in terms of the applicable legislation on data protection, to the extent that this is necessary for the appropriate conduct of the business relations and conforms to the applicable statutory provisions. For information about Issuer data protection practices, Client has to read Issuer’s Privacy Policy at https://premiocard.com/en/privacy-policy. Client may request that an electronic copy of the Issuer Privacy Policy be sent to Client in PDF via e-mail.

8.2 Client Identity Verification; Anti-Money-Laundering Requirements:

(a) Client acknowledges that Issuer is offering and continues to offer the Services to Client on condition that Client satisfies all due diligence and identity checks that Issuer conducts, and that Client complies with Issuer, Card Organization, and regulatory anti-money-laundering requirements. Identity checks may include credit checks, anti-money- laundering checks required by relevant legislation, checks required by card associations and checks to meet relevant regulatory requirements. Client will provide all assistance requested by Issuer in carrying out such checks and determining compliance with anti-money-laundering requirements, including the provision of such additional registration or identity verification information as Issuer may require.

(b) Client consents to Issuer sharing with and obtaining from third parties, both inside and outside the European Economic Area, and to the extent permitted by law, information held about Client, including personal data as defined under relevant data protection legislation, for the purpose of Issuer conducting applicable due diligence and identity checks, and Client agrees that such third parties may retain the information shared in this way.

8.3. Client may only use the Service in bona fide and in accordance with the functionalities of the Service and the use of Card as defined by the Card Organization and in compliance with this Agreement. It is strictly forbidden to use the Service in violation of the Agreement, or for any illegal purposes including but not limited fraud, money laundering, tax evasion or other illegal activities or breach of this Agreement.

8.4. Non-satisfaction of these conditions may result in immediate suspension of the Client's use of the Service, blocking of PremioCard, right of Issuer to withhold funds for satisfaction of damages incurred by Issuer, because of Client breach, claim by Issuer against Client, initiation of procedures before competent regulatory bodies or Card Organizations, and also termination of this Agreement without prior notice to Client.

9. Service Fees. Currency Conversion Fees

9.1 Issuer will charge Client fees to use the Service, as specified in the Tariff. Tariff may be changed by Issuer unilaterally with 2-month notice to Client. Updates in Tariff will be indicated on the Website, and the Client will be duly notified in accordance to the Agreement.

9.2. Payment transactions with Card, made in a currency other than the currency of the issued Card, will be converted by Issuer applying foreign exchange fee expressed as a certain percentage above the effective conversion exchange rate of the respective Card Organization for day in which the payment transaction has been executed, cleared or settled with the Card Organization. Foreign exchange fee is shown in the tariff and retained by Issuer.

10. Redemption of e-money

10.1. Client is entitled to request personally by sending an e-mail to Issuer to redeem (buy back) part or all available balance of e-money of Client, less all applicable fees. After a successful completion of verification of Client’s identity, including applicable anti-money-laundering, fraud and other illegal activity checks of every request for redemption by Issuer, Issuer will redeem the amount of the outstanding e-money, less the applicable fees, such as redemption fee, determined in Tariff or currency conversion fees if applicable and possible bank transfer fees for the bank transfer. Issuer shall initiate transfer of the remaining amount to Client personal bank account, which has to be in the same currency as the currency of Client PremioCard. The personal bank account of the Client must be held with a reputable EU bank or payment service provider. Client cannot request and is not entitled to e-money redemption if there is no balance available in Client PremioCard for whatsoever reason or balance is not enough to cover the fees for redemption.

10.2 If the outstanding amount of e-money cannot be redeemed in accordance with this Agreement, Client has six (6) years following termination of the Agreement to request the redemption of the outstanding amount in full and in compliance with this Agreement, after which time any e-money left in Client PremioCard becomes the property of Issuer. For the purposes of this clause, the Agreement terminates when Client is no longer able to use Client e-money for the purpose of making transactions or use of the Service. Nothing in this clause limits Issuer's right to terminate the Agreement, pursuant to the other clauses of this Agreement or the law.

11. Client’s liability

11.1. Consumers shall be liable for all losses incurred in respect of unauthorized transactions, as a result of use of lost or stolen payment instrument up to a maximum of 50 EUR. Client who has not acted as a Consumer shall be liable without limitation for all losses incurred in respect of unauthorized or incorrect transactions, as a result of use of lost or stolen payment instrument or incorrect payment orders.

11.2. However, Client shall be fully liable for all losses incurred in respect of unauthorized transactions and/or all damages, notwithstanding the amount of the losses or damages, if Client has acted fraudulently or has, with intent or gross negligence, failed to comply with the Agreement or law, including Client’s obligations to preserve the security of Card, personalized characteristics or identifying credentials or other.

11.3. Client agrees to indemnify, defend and hold harmless Issuer, from and against any losses or negative balance on Cards, resulting from any and all actions, causes of actions, claims, demands, liabilities, judgments, damages or expenses (collectively, "Claim" or "Claims") which Issuer may at any time during the term of this Agreement or after its termination incur, sustain or become subject as a result of any Claim and: (a) connected to the Client’s or 3rd parties using the e-money or Card/s breach of any provision, warranty or representation in this Agreement, or laws or regulations of Card Organizations or other Organizations; or (b) arising out of the Client’s or 3rd parties using the e-money or Card/s willful acts or omissions, gross negligence, or wrongdoings, or fraud, charge back, offline transactions, recurring transactions, currency conversions, pre-authorization, manual operations, stand-in process, system malfunction, or other unlawful use of the Cards and/or e-money. Client agrees that Issuer is authorized to satisfy immediately as they become due any obligations of Client under this Agreement by debiting or withdrawing directly funds from the Client’s e-money or PremioCard, or any outstanding sums owed by Issuer to Client, including by debiting or charging other e-wallet of Client provided by Issuer or the funding instrument of Client, linked to the e-wallets (if there is such). Issuer will inform Client on the ground, amount and value date of such withdrawals.

12. Termination of Agreement

12.1. The Agreement will continue to apply until terminated either by Client or Issuer, as set out below.

12.2. If Client wants to terminate legal Agreement with Issuer, Client may do so immediately and without charge for termination at any time by:

(a) Notifying Issuer, in accordance with clauses for communication by Client to Issuer below; and

(b) Redeeming the available balance of e-money (if any); and

(c) Return of Card/s to Issuer.

12.3. Client will remain liable for all obligations arising in relation to e-money or PremioCard upon Termination of Agreement and/or closing of Account, such as reversals, chargebacks, claims, fees, fines, penalties and other liabilities under this Agreement.

12.4. ISSUER may, at any time, terminate the Agreement with Client with immediate effect if:

(a) Client has breached any material provision of the Agreement or law or Regulations of Card Organizations or other Organizations; or

(b) Issuer is required to do so by law or Regulations of Card Organizations or other Organizations (for example, where the provision of the Service to Client becomes unlawful).

12.5. INACTIVITY. ISSUER may terminate the agreement automatically and without notice in case the Client has not used the product for a period of 2 (two) years. In case the client has an available balance in its account at the moment of termination, the funds shall be moved into a holding account and the Client may carry out the Redemption of e-money procedure described herein to receive said funds. For the purposes of the present article “not using the Service” shall mean not carrying out a credit or debit transaction on a POS or ATM device.

12.6. Unless a shorter period is provided in this Agreement, as permitted by law, Issuer may, at any time, terminate the Agreement by giving Client two (2) months' notice.

13. Limitation of Liability

13.1. Nothing in the Agreement will exclude or limit Issuer’s liability for losses which may not be lawfully excluded or limited by this Agreement or by applicable law. Subject to this rule, Issuer, its Branches or Agents, will not be liable to Client for:

(a) Any indirect or consequential losses which may be incurred by Client.

(b) Any loss or damage which may be incurred by Client as a result of:

(i) Any reliance placed by Client on the completeness, accuracy or existence of any advertising, or as a result of any relationship or transaction between Client and any advertiser whose advertising appears on the Service;

(ii) The deletion of, corruption of or failure to store any communications data maintained or transmitted by or through Client use of the Service;

(iii) Client failure to provide Issuer with accurate account information; and

(iv) Any fraudulent use of the Service by Client or third parties;

14. Changes to the Agreement

14.1. Client agrees that Issuer may make changes to the Agreement from time to time. Any changes to the preliminary information, which Issuer is obliged by law to present to Client, such as for example changes in Tariff, changes in the Payment Services Provider, changes in the applicable languages, redemption of e-money, or other required by law, shall be proposed by Issuer to Client with a two (2) months' notice of such changes by email sent to Client email address and/or by notifying Client on the User Interface/platform for the Service before their proposed date of entry into force.

14.2. Client understands and agrees that Client will be deemed to have accepted the changes unless Client notifies Issuer to the contrary by notice, as provided in clause 15.4, prior to the date on which the changes are to come into effect, in which case the Agreement will terminate without charge for termination immediately before the effective date of the changes. Client also has the right to terminate the Agreement immediately and without charge for termination at any time before the effective date of the changes.

14.3. Nothing in this Section will limit Issuer’s right to update and revise its policies from time to time or to add new features from time to time without prior notice, which may be accepted by Client by using the new feature. Such revisions may take place using a method chosen at Issuer's discretion, and such method may include email communication or publication on the website for the Service.

15. Communications and Notices

15.1. Statements, notices and other communications to Client may be made by mail, email, postings on the Issuer’swebsite for the Service or other reasonable means in English or where available in other languages for convenience of Client. For each transaction made through the Service we shall provide to the Client information about its execution deadline, the fees to which Client will be subject and, if applicable, a breakdown of the fees, provided such information is requested prior to execution. Furthermore, once the fees have been debited from Client’s PremioCard account, we shall provide the Client with the following information:

(i) a reference number that enables Client to identify each payment and, if applicable, information about the beneficiary;

(ii) the amount involved in each payment;

(iii) the amount of any fees charged and, if applicable, the corresponding breakdown; and

(iv) the date of debit or receipt of a payment order.

Client is entitled to request this information to be provided or made accessible regularly, at least once a month, free of charge, provided that Client is allowed to store this information and reproduce it without changes.

15.2. Issuer may communicate with Client regarding the Service by means of electronic communications, including (a) sending email to Client email address or (b) posting notices or communications on Issuer’s website for the Service. Client agrees that Issuer may send electronic communications to Client in relation to any matter relating to Client use of the Service, including the Agreement (and revisions or amendments to the Agreement), notices or disclosures regarding the Service and payment authorizations.

15.3 Client should maintain copies of electronic communications by printing a paper copy or saving an electronic copy, and information that is provided to Client in an electronic format is provided under the assumption that Client will be able to print or save such information.

15.4 Any notice sent to Issuer under this Agreement should be sent by registered post to Issuer’s address of registered office, stated above in the Agreement, and marked for the attention of PremioCard Team, except that:

(i) Notification of loss, theft, unauthorized use or security breach must be made immediately to the Contact Center of Issuer, on numbers notified to Client by Issuer or has to be sent, as soon as possible, via email to Issuer;

(ii) Notification of application for PremioCard, and purchase of e-money, redemption of e-money and/or termination of this Agreement should be sent via email to Issuer;

(iii) Notification by Client that Client does not agree to the amendment of the Agreement and wishes to terminate the Agreement prior to entry into force of the amendments should be sent via email to Issuer.

16. General legal terms

16.1. Client agrees and acknowledges that the reporting and payment of any applicable taxes arising from use of the Service, which are obligations of Client, is Client exclusive responsibility and liability.

16.2. Client agrees that Client will not reproduce, duplicate, copy, sell, trade or resell the Service for any purpose.

16.3. Issuer may assign the benefit or otherwise sub-contract or transfer its rights and obligations under the Agreement to any third party with 2 months’ notice to the Client, without diminishing the quality of the Service.

16.4. Any claim or dispute arising under the Agreement or as a result of the provision of the Service by Issuer should, in the first instance, be referred to Issuer to the following email: info@premiocard.com. Client has to submit Complains in writing and clearly stating the reasons for complaint. Issuer shall review the complaint within 15 days from its receipt under the condition that the complaint is presented in a clear and understandable manner and is submitted correctly. In case there is no reply to the complaint due to circumstances that are beyond the control of the Issuer the latter shall be obliged to write back to the Client with the reasons for the delay and the reasonable time in which the issue subject of the complaint will be resolved. In any case the rectification of the issue will be provided within 35 days from the receipt of the complaint from the Client. Client may refer any complaints not resolved to Client satisfaction to the for examination by the Conciliation Commission for Payment Disputes on the following address: Bulgaria, Sofia, 4A Slaveykov Square, fl. 3, which is entitled to offer out-of-court solution, which have to be accepted by both parties.

16.5. Both Parties agree that the authentic and/or correct execution of transactions and operations by Issuer may be proven with various legal means, including expertise or print-outs or statements printed or generated from the Issuer’s IT systems, such as the User Interface of the Service, or Internet website of Issuer for the Service, Card System of Issuer, Register of E-money or other software systems used by Issuer, Agents or sub-contractors of Issuer in its capacity of regulated E-Money Institution.

16.6. “PremioCard”, www.PremioCard.com and all related URLs, logos, marks or designs, software, interfaces or other related to the Services, including logos and marks of Card Organizations are protected by copyright, trademark registration or Patent or other intellectual property right of Issuer or third party Licensor. Client may not use, copy, imitate, modify, alter or amend, sell, distribute or provide them without Issuer’s prior written explicit consent to do so in a separate Agreement.

16.7. Both Parties agree to submit to the non-exclusive jurisdiction of the competent Bulgarian courts in Sofia to resolve any dispute arising between them. Nevertheless the Client agrees that Issuer will still be allowed, upon Issuer’s discretion, to bring a claim or apply for injunctive remedies (or an equivalent type of urgent legal relief) in any jurisdiction.

| Tariff: | |

|---|---|

| PremioCard™ Card issuing fee | Free of charge |

| PremioCard reissuance | 10.00 EUR |

| ATM cash withdrawal in EU | 2.00 EUR |

| ATM cash withdrawal International | 5.00 EUR |

| POS cash withdrawal | 1% + 3 EUR |

| Payment on POS terminal | Free of charge |

| Internet payments | Free of charge |

| Blocking/Unblocking of a PremioCard | Free of charge |

| SMS notification | 0.20 EUR |

| Fee for initiating chargeback procedure | 15.00 EUR |

| E-money redemption from the Issuer | 15.00 EUR |

| ATM Balance check | 0.50 EUR |

| Declined transaction at ATM | 0.50 EUR |

| Currency exchange fee | 1.00% |

| For PremioCard Non-Reloadable: | |

| PremioCard loading fee 0 – 300.00 EUR | 1.00 EUR |

| PremioCard loading fee 300.01 – 3000.00 EUR | 3.00 EUR |

| PremioCard loading fee > 3000.01 | 7.00 EUR |

| Service monthly fee charged 3 months after the loading | 5.00 EUR |

| Inactivity monthly fee charged 1 year after the last transaction* | 15.00 EUR |

| Inactivity monthly fee charged 3 year after the last transaction* | 50.00 EUR |

| For PremioCard Reloadable: | |

| PremioCard loading fee 0 – 300.00 EUR | 1.00 EUR |

| PremioCard loading fee 300.01 – 5000.00 EUR | 3.00 EUR |

| PremioCard loading fee > 5000.01 | 10.00 EUR |

| PremioCard activation fee | 7.00 EUR |

| Inactivity monthly fee charged 1 year after the last transaction* | 15.00 EUR |

| Inactivity monthly fee charged 3 years after the last transaction* | 50.00 EUR |

| *Inactivity means a period of time during which the Client does not carry out any transactions with Client’s PremioCard card. In such case Issuer will deem the PremioCard card to be inactive or dormant and shall charge the respective fee amount as show in the Tariff. | |